Patriot Manager’s Monitoring function provides the most comprehensive activity analysis, having 60+ alerts that can be generated specific to the insurance industry.

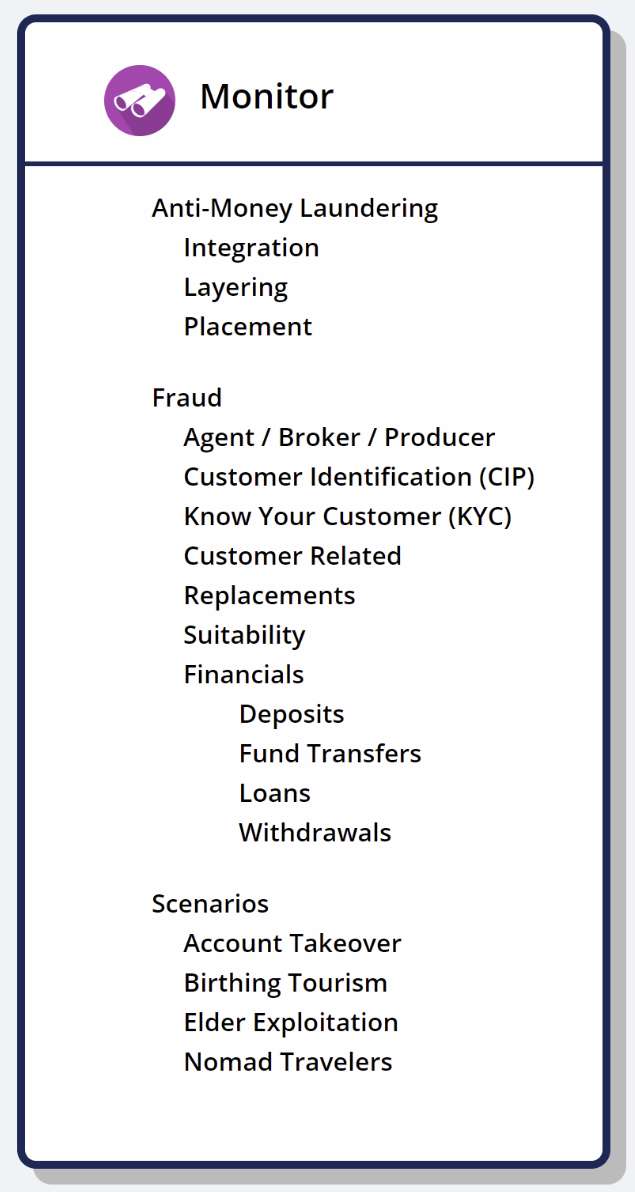

Monitoring includes:

Anti-Money Laundering (AML) – in-depth analysis of your customer’s movement of funds (deposits and withdrawals, loans, and transfers).

Anti-Money Laundering (AML) – in-depth analysis of your customer’s movement of funds (deposits and withdrawals, loans, and transfers).

Fraud – analysis of customer and agent activity.

Scenarios – analysis of single activities and multiple activities across periods of time.

Every insurance event that could be considered suspicious is analyzed.

Do you have an activity not shown? Contact us, and ask your question. Aquilan is continually expanding the power of the Monitoring function.